The rapidly changing and dynamic business environment warrants change, which has not left CPA and accounting firms untouched. CPA firms are constantly searching for alternatives to the present-day conundrum to find a way to improve their services and maintain a competitive edge. This has brought the concept of white-label accounting services to the fore.

The recent wave of technological expansion and higher client expectations mean that CPA firms cannot depend upon the time-tested tactics of the past. Instead, they must follow the tide and look for strategies to elevate their services and maintain a competitive edge. They are increasingly leveraging white-label services to broaden their services portfolio without the hassle of an extensive in-house team.

Thus, CPA and accounting firms are now transitioning from the traditional approach of providing accounting services and are now tapping into specialized expertise to deliver a more comprehensive suite of services in a fast-evolving business landscape. Thus, incorporating white-label accounting services is seen as a forward-looking strategy to meet today’s ever-increasing and intricate challenges.

Now that we have looked at why white-label accounting services are essential for the modern accounting industry let us understand the benefits of this strategy. But let’s first understand briefly what white-label accounting services are.

What are White Label Accounting Services?

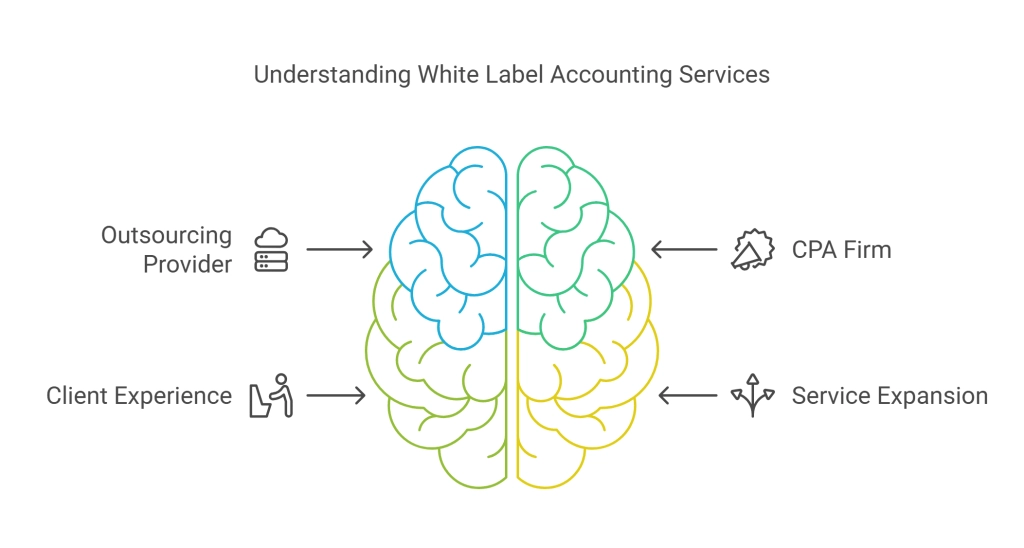

White-label accounting services involve outsourcing specific accounting tasks to a third-party provider, who delivers these services under the CPA firm’s brand, maintaining a seamless client experience. The CPA or accounting firm collaborates behind the scenes with the outsourcing provider while maintaining its distinct identity in front of the client. This means the CPA firm can now expand its service offerings without relying on in-house expertise, especially in accounting.

Let us understand some advantages of deploying white-label accounting services for CPA or accounting firms.

Advantages of White Label Accounting Services for CPA Firms

-

Cost Efficiency:

White-label accounting services offer a highly cost-effective solution. Instead of hiring and training additional staff for various tasks, firms can outsource accounting functions to seasoned experts. This reduces operational costs and allows CPA firms to allocate resources more strategically and efficiently.

-

Scalability:

White-label accounting services allow CPA and accounting firms to scale operations up or down based on demand. During peak seasons, firms can access additional resources without the long-term commitment of full-time hires. Similarly, they can adjust resource allocation in lean periods to maintain efficiency and control costs.

-

Focus on Core Competencies:

By outsourcing non-core functions—such as audit services, tax planning, and financial consulting—CPA and accounting firms can concentrate on their core competencies. This approach enhances service quality and helps firms maintain a competitive edge in the marketplace.

-

Improved Client Satisfaction:

Offering white-label accounting services enables CPA and accounting firms to meet broader client needs. This results in higher client satisfaction and fosters long-term loyalty.

-

Embracing Technological Innovation:

The accounting sector is evolving rapidly with technological advancements. White Label accounting service providers prioritize investing in cutting-edge tools and technologies. By collaborating with these providers, CPA and accounting firms can access advanced solutions without significant upfront costs, ensuring they remain competitive and aligned with industry trends.

-

Access to Niche Expertise:

The accounting field encompasses various specialized areas, from forensic accounting and international taxation to software implementation. White Label accounting services give CPA and accounting firms access to a network of experts in these niche domains, enabling them to deliver high-quality, specialized services without the burden of extensive hiring or training investments.

-

Enhanced Risk Management:

Partnering with White Label accounting service providers helps CPA and accounting firms navigate risks tied to compliance, regulatory changes, and shifting accounting standards. With their dedicated focus on specific areas, these providers stay updated on industry developments, minimizing the chances of errors or oversights that could impact the firm or its clients.

White-label Accounting Services: How KMK Can Help

At KMK, we specialize in providing seamless white-label accounting services tailored to CPA firms’ needs. Our team of experienced professionals helps you expand your service offerings without the challenges of building and managing a large in-house team. By partnering with KMK, CPA and accounting firms can access cost-effective, scalable, and technology-driven solutions that enhance efficiency and client satisfaction. From managing routine bookkeeping to delivering advanced tax preparation and compliance support, KMK empowers CPA and accounting firms to focus on their core strengths. At the same time, we care for the rest—all under your brand name.

Conclusion

In today’s fast-paced accounting industry, white-label accounting services have become more than an option—they are necessary. This innovative approach allows CPA and accounting firms to deliver comprehensive services, reduce costs, and stay competitive in an ever-evolving landscape. Partnering with trusted providers like KMK ensures that your firm can meet growing client expectations while maintaining the quality and reputation your brand stands for.

You may also like – Top 5 Red Flags to Avoid When Offshoring Accounting to India